Most Used Categories

terms. The goal of credit risk management is to maximize a bank’s risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. As the Basel II put it, banks need to manage the credit risk inherent in the entire portfolio as well as the risk in individualcredits or transactions In terms of importance, credit risk is one of the most important functions in banking as it represents the foundation of how banks earn money from deposited funds they are entrusted with. This being the case, the manner in which banks manage their credit risk is a critical component of their performance over the near term as well as long blogger.comted Reading Time: 10 mins An investigation into the influence of credit ratings on credit risk of the South African banking industry Choenyana, Kgapyane Samuel () The financial stability of banks is crucial if they are to fulfil their role in facilitating transactions between borrowers and lenders

Enjoy amazing features with us

In terms of importance, credit risk is one of the most important functions in banking as it represents the foundation of how banks earn money from deposited funds they are entrusted with. This being the case, the manner in which banks manage their credit risk is a critical component of their performance over the near term as well as long blogger.comted Reading Time: 10 mins Dissertation Examples. ORDER NOW TUTORS What you'll get from blogger.com! % Original – written from scratch Guaranteed privacy – no third-party ever involved Native-English Home Dissertation Examples Credit Risk Management In The Uk Banking Sector. Search Credit Risk Management In Banks Dissertation, Funny Homework Assignments From Teachers, Word For Doing Homework, Examples Of Literary Analysis For Macbeth, Grade Calculator What Can I Get On My Essay To Keep My Grade, Essay On Co Education Is Bad, Comparative Film Essay Example

Let’s write a paper for you in no time

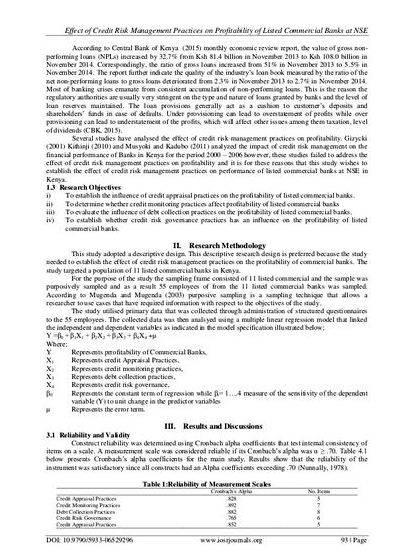

In terms of importance, credit risk is one of the most important functions in banking as it represents the foundation of how banks earn money from deposited funds they are entrusted with. This being the case, the manner in which banks manage their credit risk is a critical component of their performance over the near term as well as long blogger.comted Reading Time: 10 mins CREDIT RISK EXECUTIVE SUMMARY The future of banking will undoubtedly rest on risk management dynamics. Only those banks that have efficient risk management sy Alternate Hypothesis: Credit risk management has a relationship with the bank performance. Figure 3. 1: The conceptual model The general research objective is to determine the relationship between credit risk management and bank performance and investigate the impact of moderating and intervening variables which in this case are

Recent Submissions

Credit Risk Management In Banks Dissertation, Funny Homework Assignments From Teachers, Word For Doing Homework, Examples Of Literary Analysis For Macbeth, Grade Calculator What Can I Get On My Essay To Keep My Grade, Essay On Co Education Is Bad, Comparative Film Essay Example Credit risk management allows predicting and forecasting and also measuring the potential risk factor in any transaction. The banks management can also make use of certain credit models which can act as a valuable tool which can be used to determine the level of lending measuring the risk. It is always better to have some alternative techniques The goal of credit risk management is to achieve the maximum risk adjusted rate of return by identifying credit risk inherent in individual bank transactions as well as portfolios and controlling the credit risk exposure to an acceptable level

terms. The goal of credit risk management is to maximize a bank’s risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. As the Basel II put it, banks need to manage the credit risk inherent in the entire portfolio as well as the risk in individualcredits or transactions Credit risk management allows predicting and forecasting and also measuring the potential risk factor in any transaction. The banks management can also make use of certain credit models which can act as a valuable tool which can be used to determine the level of lending measuring the risk. It is always better to have some alternative techniques This risk can be further classified into Credit risk and Market risk. i) Credit Risk Credit Risk is the potential that a bank borrower/counter party fails to meet the obligations on agreed terms. There is always scope for the borrower to default from his commitments for one or the other reason resulting in crystalisation of credit risk to the bank

No comments:

Post a Comment